Looking at all the standards activity around 5G, it is easy enough to see reflections of the reality that voice is a fundamental feature for a communications provider, but drives a declining portion of revenue. All of the future revenue upside, in other words, comes from internet access and the services that access enables.

Simply put, all the 5G activity is around mobile and fixed data. It is not clear that voice ever again will be a primary problem to be solved.

Some might argue that voice might become a bigger concern for mobile generation seven. Others might argue 3G was the last mobile network platform centrally concerned with voice.

Many speculate that mobile generation six could focus more on integrating mobile and satellite links, as 5G integrates licensed and unlicensed spectrum. That might also be an indication that mobile issues, as such, largely have been developed to a point where commercial attention turns elsewhere.

Some might argue that voice might become a bigger concern for mobile generation seven. Others might argue 3G was the last mobile network platform centrally concerned with voice.

Many speculate that mobile generation six could focus more on integrating mobile and satellite links, as 5G integrates licensed and unlicensed spectrum. That might also be an indication that mobile issues, as such, largely have been developed to a point where commercial attention turns elsewhere.

For the moment, most service providers in developed markets are trying to harvest voice revenues. In developing markets, voice remains a key revenue driver, particularly because subscription growth remains relatively high.

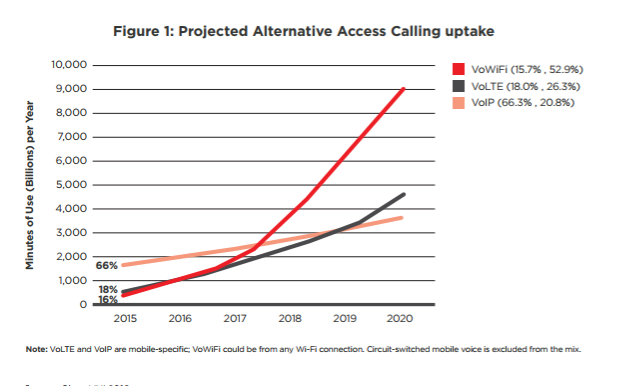

In fact, we might be entering an era where mobile data becomes more akin to a feature than a revenue driver as well, following the pattern of voice services. To be sure, voice over LTE is expected to grow, in the 4G realm. Other forms of voice using an over-the-top method also will grow, though.

If you take the long view, some “news” items are not surprising. If you observe that mobile data revenues are peaking, then it is not too surprising when a decline occurs. Analyst Chetan Sharma notes that U.S. mobile data services revenue had seen quarter-over-quarter growth for 17 straight years until the first quarter of 2017.

In that quarter, revenue growth went negative.

Verizon saw its first-ever decline in service revenues, year over year.

For the first time, industry postpaid net-adds also were negative, while, for the first time, cars accounted for 50 percent of the total net-adds for the quarter, Sharma notes.

A product lifecycle top has been coming for some time. In developed markets, after “everyone who wants to use mobile” is doing so, and when “everyone who wants to use mobile data” is doing so, and when “everyone uses as much as they need”, the market simply is saturated.

And that means, as executives have understood, drives the search for big sources of new revenue to displace the lift once provided by mobile data services.

So 5G is not simply the latest in a series of mobile network generations, defined in part by air interface or data rate. In fact, that often is the way 5G is described. No, 5G is something else, a deliberate attempt to build a network with intrinsic support for non-human users (internet of things).

Some might note that this is precisely what many have called pervasive computing, a world in which almost anything can have computing and communications embedded.

That might not be so obvious at first, as the first “at scale” deployments of 5G will focus on extending services for humans (“enhanced mobile broadband”). Ironically, though mobile data is reaching saturation, the first “at scale” revenue benefits and value might well be generated by mobile or fixed broadband.

Most industry executives seem to agree that, at first, most of the customer-observed value will come from higher data rates. None of that should obscure the more fundamental hope, though. And that is that 5G networks will enable a big new internet of things business delivering services to non-human users.

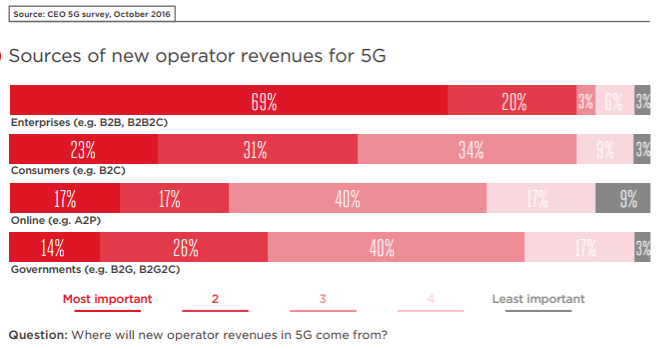

Among the biggest hoped-for changes is in business model. Industry executives believe that new revenues disproportionately will come from enterprises, not consumers, undoubtedly a reflection of the expectation that the incremental new revenue streams will be created by various internet of things services and applications.

No comments:

Post a Comment