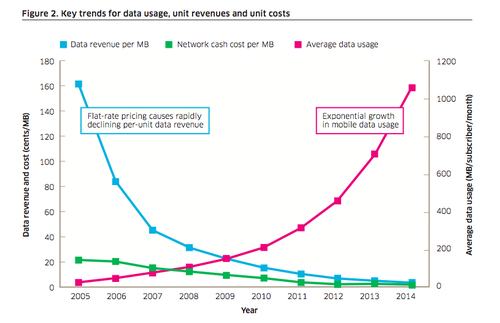

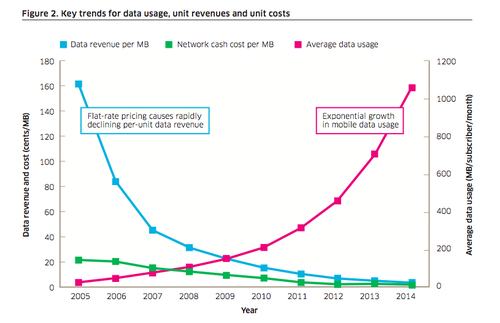

Mobile data presents a business model problem we did not see in the voice era. In the past, increased usage was incrementally matched by additional usage revenue. Even when the correspondence was not 1:1, increased usage inevitably lead to higher revenue.

Mobile data often presents a different business issue. Unlimited usage, for example, means potentially much-higher usage, with no revenue upside. And even where usage is not formally unlimited, increased usage typically leads to incremental revenue that likely does not keep pace with the costs of providing the additional capacity.

That has been a problem for some years.

source: Nokia (Alcatel-Lucent)

Mobile data often presents a different business issue. Unlimited usage, for example, means potentially much-higher usage, with no revenue upside. And even where usage is not formally unlimited, increased usage typically leads to incremental revenue that likely does not keep pace with the costs of providing the additional capacity.

That has been a problem for some years.

source: Nokia (Alcatel-Lucent)

The present issue is not that revenue per gigabyte is a negative number. The problem is that, eventually, that could happen.

John de Ridder at IT Wire asks a couple of important questions about a possible end to scarcity of mobile bandwidth; price points for mobile bandwidth that could make mobile data usage a substitute product for fixed internet access, and at least conceptually, the idea that mobile might, in the 5G era, become a functional substitute for fixed access.

Right now, such substitution makes sense for some customers; not all. The frequent use case is a single user, mobile centric, using a mobile device for virtually all personal internet access, and doing so to save money. Such a user might and rely on Wi-Fi for long form video consumption or not watch much long form video.

That use case can make “mobile only” internet access a reasonable option. Up to this point, multi-user households and households where significant video is consumed have not generally been ideal candidates for mobile substitution, largely because fixed consumption typically is an order of magnitude higher than mobile consumption, and because mobile cost per gigabyte also is higher by perhaps an order of magnitude (10 times higher) or two orders of magnitude (100 times higher).

That could change.

Several developments would have to happen: faster mobile speeds; a shift to functionally unlimited mobile data usage (practically speaking, there always are some limits, but usually those limits are set high enough that the typical user does not have to worry about excessive usage and attendant costs); and a cost-per-gigabyte that approaches what is offered by fixed services.

In other words, mobile data bandwidth has to change from being a “scarce” commodity to becoming an “abundant” resource, which is among the differences between fixed and mobile internet access services for consumers.

Such abundance is potential good news (mobile substitution opens a big new market for some mobile operators) but also potential bad news (network bandwidth will have to expand by an order of magnitude or two orders of magnitude, but revenue will not increase, per account).

That latter possibility (a shift to unlimited usage including lots of video) now is a “negative” that mobile executives will insist is a “positive,” though. In the U.S. market, where the all the biggest four mobile operators now heavily are marketing “unlimited usage” plans, just about all the company executives say their spectrum holdings now mean they are well prepared for competition based on unlimited usage as a continuing and defining offer.

Michael Henshaw, Petra Capital director, forwarded this look at the impact of unlimited mobile data plans and the possible implications for mobile substitution. The clear business problem is the combination of potentially much-higher usage and capped revenue.

of the mobile business, precisely because data consumption will not be matched by revenue increases of equivalent magnitude.

No comments:

Post a Comment